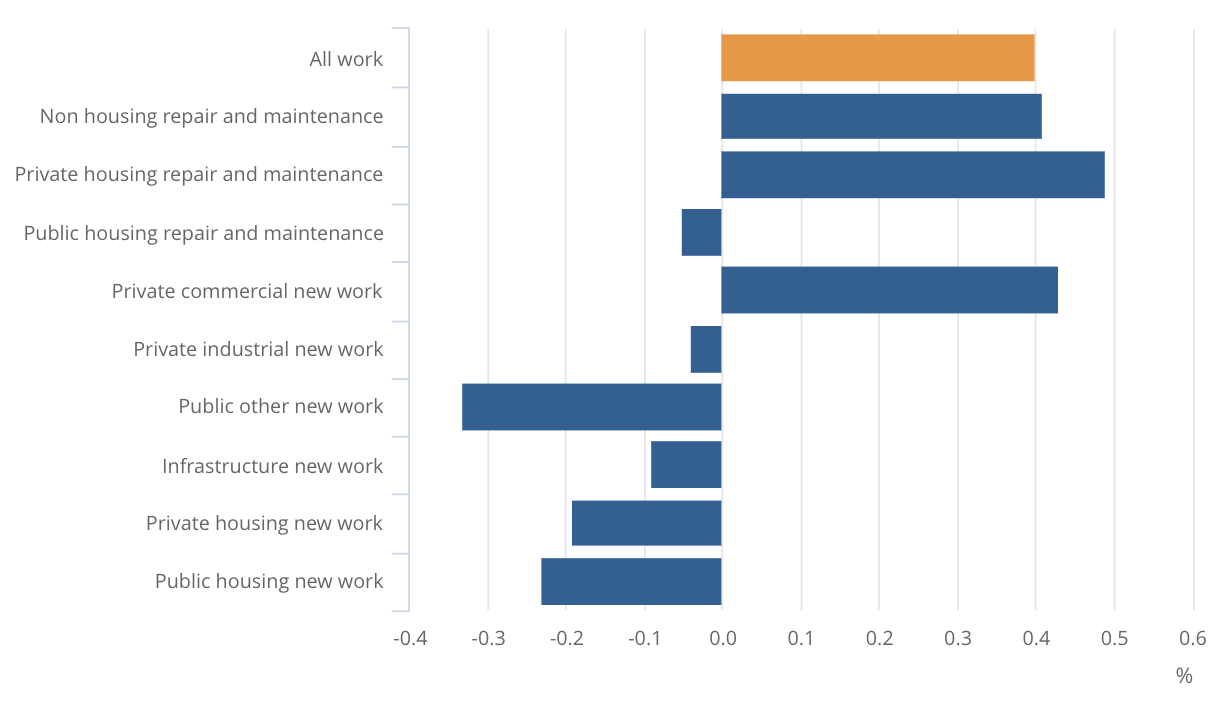

The 0.4% recovery was driven by a 2% rise in repair and maintenance, which offset another fall in new work during the month of 0.8%.

In the new work sector, the only sector to register growth was commercial, which rose 3% monthly and is now 5% up on a year ago.

There was also a glimmer of hope for the market from new order figures which increased 3.9% in the third quarter. This quarterly rise came mainly from public other new orders and infrastructure new orders, which increased 24% and 14%, respectively.

The annual rate of construction price inflation has now slowed to 3.9% in the 12 months to September, down from the record annual price growth in May 2022 of 10.4%.

Clive Docwra, managing director of property and construction consultancy McBains, said: “Today’s figures will provide a measure of relief for the construction industry, coming off the back of two successive months of falling output.

“While we have seen a small uptick in development lending, where schemes that were previously unviable have been re-purposed to align with current market conditions, this is not reflective of overall market sentiment, as evidenced by today’s figures showing a 0.8% decrease in new work on the previous month.

“Our clients tell us that borrowing costs are still deterring some investments, and while interest rates may have peaked, the longer-term outlook remains uncertain.

“On the plus side, the industry will welcome total construction orders increasing over the third quarter of 2023 compared with the previous quarter, as a result of new work in the public and infrastructure sectors, but volume housebuilding will take more time to see a turnaround while interest rates remain high.”

(300 x 250 px).jpg)