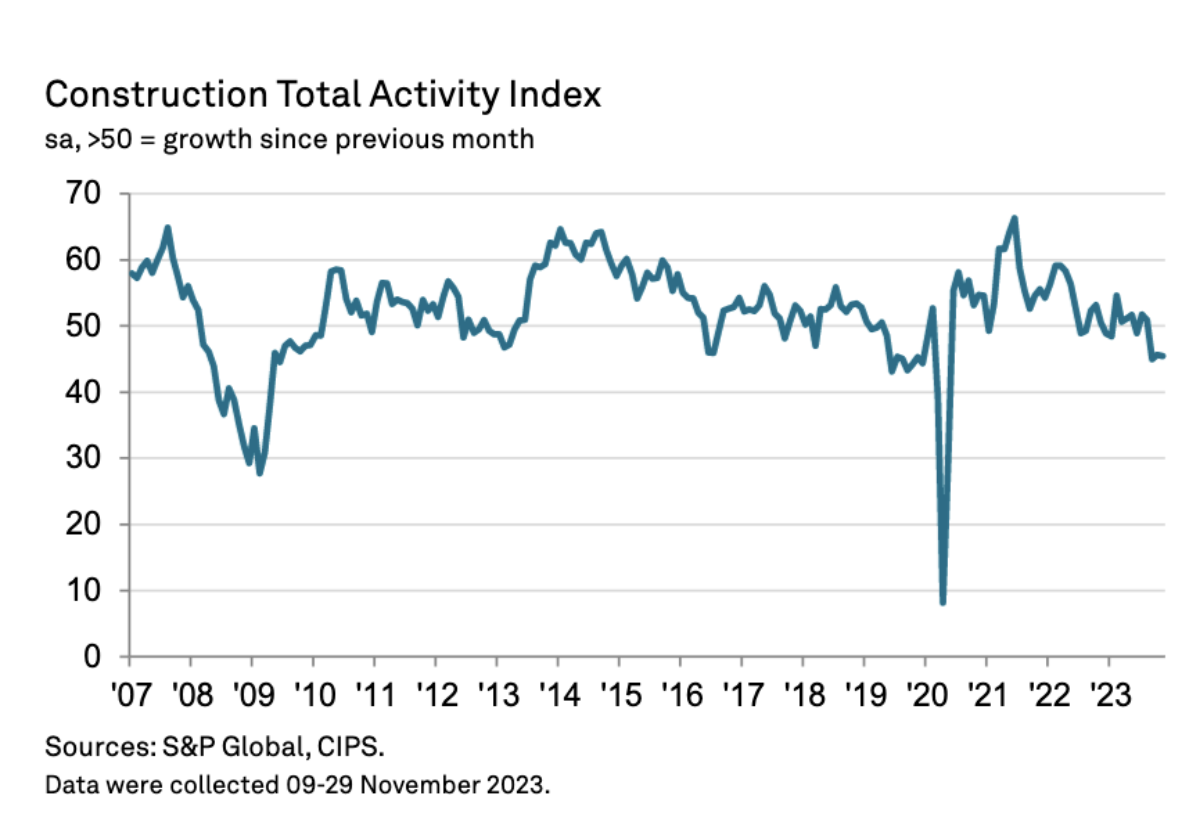

The bellwether S&P Global/CIPS UK Construction Purchasing Managers’ Index PMI registered 45.5 in November, down fractionally from 45.6 in October and below the 50.0 no-change value for the third month running.

House building was the biggest drag (index at 39.2) followed by civil engineering (43.5) as commercial building showed some resilience (48.1).

A combination of greater price competition among suppliers and falling raw material costs contributed to another decrease in input prices across construction.

The overall rate of decline was the steepest since July 2009, with survey respondents reporting falling prices paid for a range of materials especially steel and timber.

November data suggested a continued lack of new work to replace completed projects. Total new orders decreased for the fourth month running but at the slowest pace since August.

Business activity expectations for the year ahead picked up from October’s recent low, but remained notably weaker than seen in the first half of 2023.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “Improving supply conditions were evident again in November, linked to rising raw material availability and spare capacity across the supply chain.

“Greater competition among suppliers added to downward pressure on prices paid for construction products and materials. The latest survey indicated that overall input prices decreased for the second month running and at the fastest rate since July 2009.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “The sector has finally emerged from a period of intense supply chain pressure and prices are now falling across the board, especially for timber and steel.

“Projects are no longer being delayed due to unexpectedly high material costs with November seeing the sharpest reduction in purchasing prices since July 2009.

“There will be no quick fixes next year for the sector.

“Lower demand, elevated interest rates and the prospect of an election promise an uncertain start to 2024. This is a challenging moment for suppliers in the sector, who may have tough price negotiations ahead.”