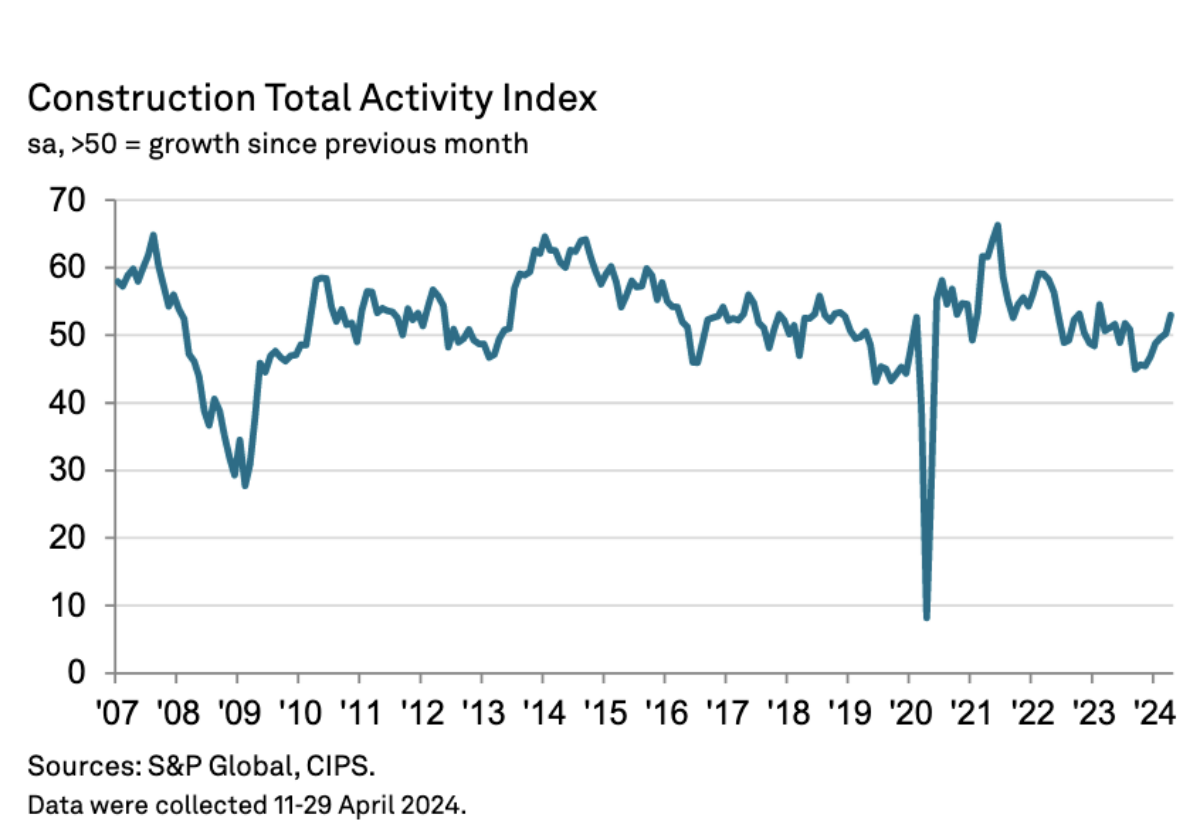

The bellwether S&P Global UK Construction Purchasing Managers’ Index posted 53.0 in April, up from 50.2 in March.

The index was in positive territory for the second month running and signalled the strongest pace of expansion since February 2023.

Commercial building (index at 53.9) increased for the first time since August 2023 and was the fastest-growing area of construction activity in April.

Survey respondents commented on rising workloads and a turnaround in customer demand, in part driven by refurbishment projects.

Civil engineering activity (index at 53.6) meanwhile expanded again in April and at the strongest pace for nine months while house building continued to fall with the index at 47.6.

Optimism regarding the year ahead also edged up in April with nearly half of the survey panel anticipating a rise in output during the next 12 months, while only 11% forecast a decline.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “The construction sector consolidated its recent return to growth in April, with total industry activity rising at the fastest pace for 14 months amid an ongoing recovery in order books.

“Demand was boosted by greater confidence regarding the broader UK economic outlook. Commercial construction outperformed in April and civil engineering also provided a solid contribution to overall growth.

“Lacklustre market conditions in the house building segment continued to weigh on activity. The latest survey pointed to the fastest reduction in residential building work since January, although the speed of the downturn remained much softer than in the second half of 2023.

“Hiring trends were subdued in April despite a recovery in workloads, which mirrored trends seen in other part of the UK economy, as construction firms sought to maintain a tight focus on costs against a backdrop of strong wage pressures. Purchasing prices nonetheless increased only modestly in April. An improved balance between supply and demand helped to contain overall input cost inflation, as suggested by the fastest improvement in vendor performance so far in 2024.

“Business activity expectations for the year ahead picked up slightly in April, supported by a sustained recovery in new orders, positive signals for sales pipelines, and anticipated interest rate cuts in the second half of 2024.”

.gif)