But a sharp rise of 16% in first quarter order figures raises hope of recovery ahead despite on-going uncertainty caused by a looming election.

In March, monthly construction output slid 0.4% in volume terms stemming from decreases in both new work (0.7% fall) and repair and maintenance (0.1% fall).

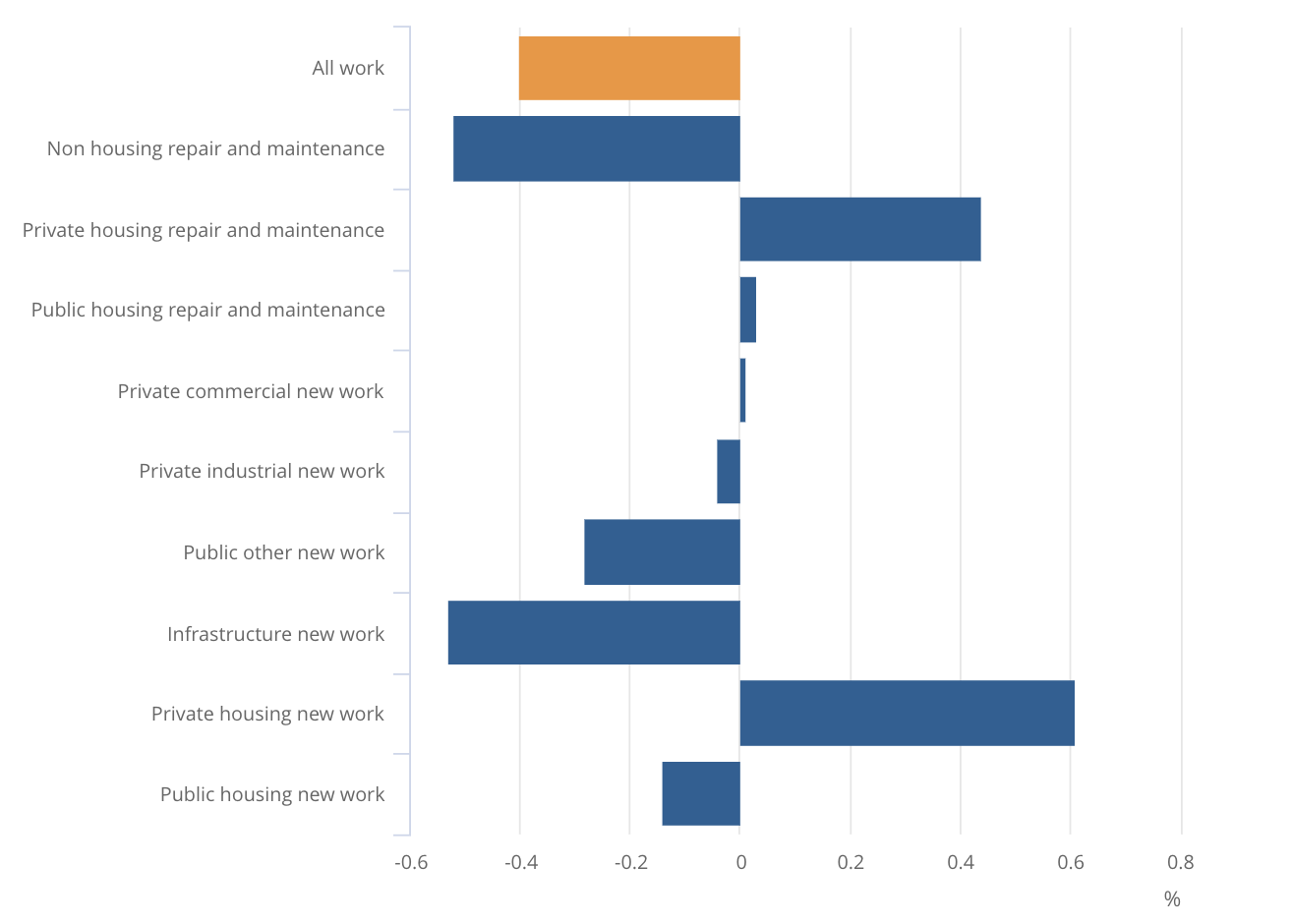

At the sector level, while five out of the nine sectors saw a fall in March, private new housing and housing RMI offered the first signs of growth for many months, up 0.6% and 0.4% respectively.

Contributions to monthly growth in March

This was offset by a contraction in infrastructure new work, and non-housing repair and maintenance offset the improvement.

During the first quarter output fell 0.9% overall dragged down solely by a 1.8% fall in new work.

Strong growth in construction new orders in the first quarter came mainly from private commercial new work and public other new work, which increased 28% and 44%, respectively.

In another more positive indicator for construction, the annual rate of output price growth fell to 1.5% in the 12 months to March 2024; down from the record annual inflation last May and June which peaked at 10.7%.

Clive Docwra, managing director of property and construction consultancy McBains, said: “With the broader economic data showing the economy grew by 0.6% in the first quarter of 2024 and is recovering from last year’s technical recession, it demonstrates that growth in the construction sector is struggling to keep pace with the wider recovery.

“A particular worry is that five of the nine construction work sectors experienced a decline in March. Infrastructure contracts, which have propped up much of the industry in recent months, saw a 3.6% decrease.

“A continuing number of variables – not least an impending general election – means that we expect the sector will continue to experience ups and downs over the next few months.”

Scott Motley, head of programme, project and cost management at AECOM, warned the construction sector would continue to endure challenging economic conditions.

“We expect the pipeline of new work to reduce in the second half of 2024, especially while interest rates remain high and the impending general election gives rise to a pause in infrastructure investment decisions.

“As such, order books are most likely to be filled by short term repair and maintenance work as firms continue to adopt a precautionary two-stage approach to major tenders to avoid overstretching themselves in a competitive market.”

.gif)

(300 x 250 px).jpg)

.gif)