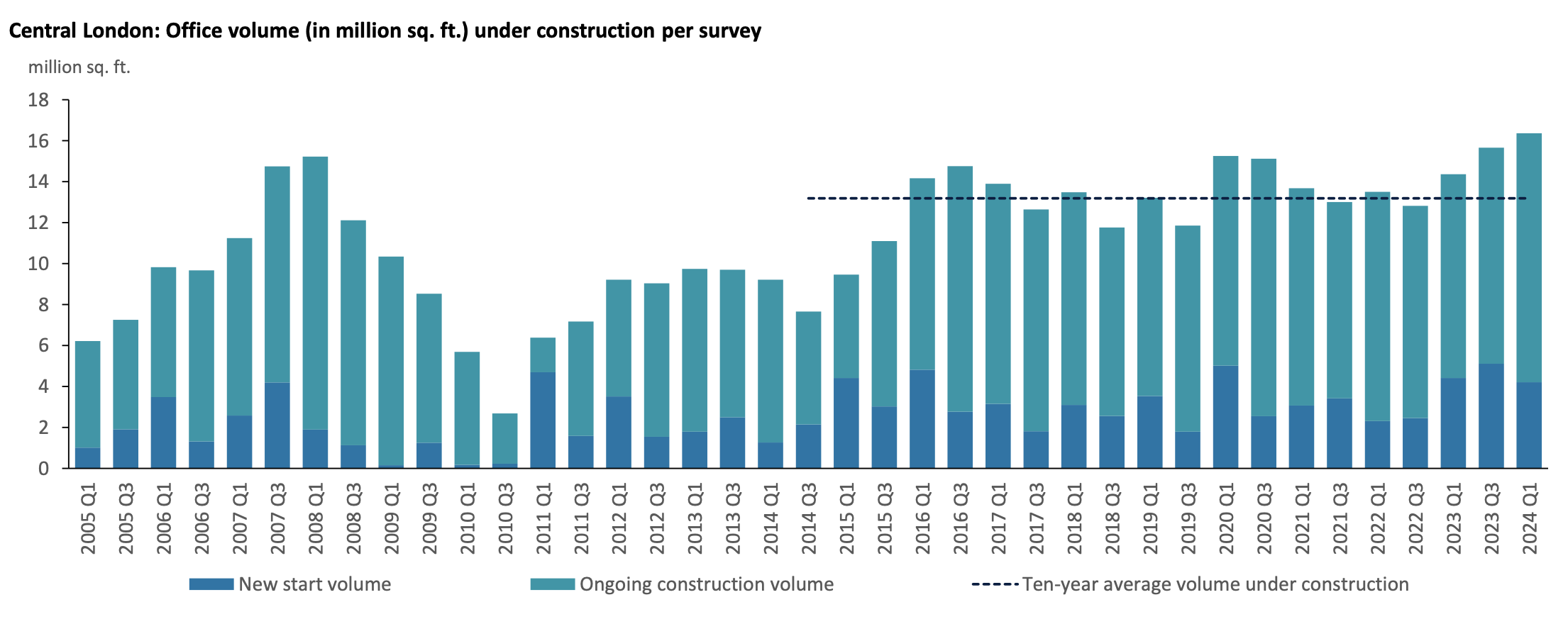

The volume under construction hit an all-time high of 16.4m sq ft across 127 schemes by March, according to the latest Deloitte London Office Crane Survey.

Much was fed from work starts in the previous two quarters of growth, but even in a slightly slower start to the year new project starts totalled 4.2m sq ft, the first time three consecutive quarters have topped 4m sq ft of new starts since the Crane Survey started.

New build saw an 18% decrease compared with the previous survey six months prior, which had reported the highest volume of new starts on record.

Despite this dip, the volume of new starts in this survey was well above the 10-year average of 3.3m sq. ft.

The total volume of refurbishment starts surpassed the new build in the first quarter at 2.3m sq ft, nearly twice new-build volumes.

Sophie Allan, director in real assets advisory at Deloitte, said: “While there has been a drop in new starts from our last crane survey, development activity remains well above the 10-year average.

“The desire for premium office space as well as the implementation of energy standards has powered projects centred on modernising outdated premises. This inclination to opt for refurbishment is a trend we foresee enduring over the next decade.”

The West End edge out the City of London, as the most active submarket for new construction activity due to three large new starts totalling 945,000 sq. ft.

Philip Parnell, partner and real estate valuation lead at Deloitte, said: “Notwithstanding the challenging economic backdrop, the ESG agenda is stimulating the need for renewal.

“Through a combination of tightening planning policy and ever-increasing focus on moving towards achieving net zero, it is fascinating to see the continued trend of increasing refurbishment activity.

“This underlines our previous assertion that investors should be conscious of an increase in the risk of stranded assets where assets do not meet occupiers’ ESG expectations, with the inevitable risk of value erosion.”

Developers surveyed said they were optimistic about the leasing market with all respondents perceiving the current market as ‘better’ than six months ago. They commented that demand for premium office space remains high, particularly in the City and West End.

MPU 300_250px.gif)

.gif)