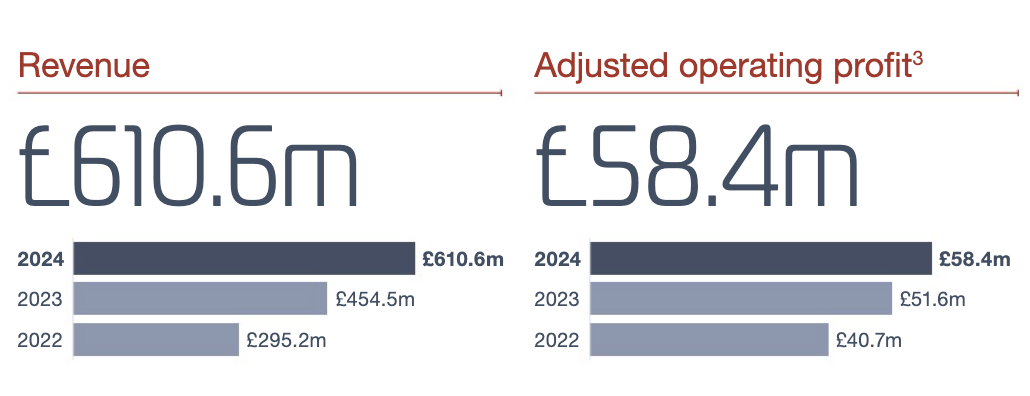

The revenue is now double the level of two years ago, when Stockport-based OCU was bought from founders Tim and Tom O’Connor by private equity group Triton Partners.

Adjusted operating profit rose 13% to £58m, which saw overall operating margin slip to 9.6% from 11.3% in the previous year.

During the year to 30 April 2024, OCU group made five strategic acquisitions. Its sixth and biggest buy so far of Scottish civil engineering contractor RJ McLeod completed after the year-end in June 2024.

This acquisition will increase OCU Group revenues to over £800m and grows the capability and capacity for work in supporting the critical UK energy transition.

Michael Hughes, CEO of OCU Group, said: “OCU continued to evolve at pace during the year – through thoughtful and strategic acquisitions and innovative organic initiatives, all driven by an exceptional team across the country.

“As we leave the year, we stand even better placed to secure the opportunities that the tailwinds in our end markets present.”

The group’s balance sheet showed a cash position of £29m (30 April 2023: £38.1m). After total borrowings including finance leases of £370m at the year end, OCU’s net debt position rose to £341m, up from £212m at the end of the prior year.

Over the year total headcount jumped 47% to 1,119, although the proportion of admin staff within the total more than halved to 186.

.gif)