The Chancellor also committed an extra £850m for school building and repairs next year and £1bn to tackle the backlog of repairs and upgrades at the country’s hospitals.

Reeves also confirmed an already trailed extra £500m to deliver 5,000 more new affordable homes.

The cash would be a top-up to the existing Affordable Homes Programme and comes ahead of the Government’s Housing Strategy due to be set out in detail in the Spring.

The clogged-up planning system will get £46m to support recruitment of hundreds of planners across the country’s local authorities.

In a set of big Budget reforms, she set out plans to raise taxes by £40bn, the bulk coming from changes to employers national insurance contributions, expected to claw in £25bn.

Among other tax changes, capital gains and inheritance taxes were raised, along with business rates and pension tax.

To fund extra spending on infrastructure, the Chancellor confirmed changes to fiscal rules to allow the value of assets to be calculated alongside liabilities.

This helps the Chancellor to raise capital investment by £13bn next year, taking total departmental capital spending to £131bn in 2025-26

The final HS2 5.4-mile tunnel drive to Euston from Old Oak Common is expected to cost around £1bn.

Skanska Costain Strabag JV are advanced with preparation works to launch the two final TBMs from the Old Oak Common Box towards Euston, despite uncertainty about the Euston terminus plan.

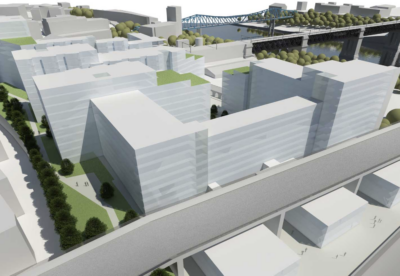

Funding for the construction of the tunnels is intended to catalyse private investment into the station and local area.

The Chancellor confirmed £1.4bn for the school rebuilding programme, including an increase of £550m this year. There is also an extra £300m next year for schools maintenance, taking upkeep spend to over £2bn in the education settlement.

Taken together this will spur 100 projects to begin delivery across England next year and begin to tackle the crumbling school and college buildings across the country.

Health capital spending will be raised next year by £1bn to £3.1bn. This extra cash will be injected into tackling dangerous reinforced autoclaved aerated concrete and the existing backlog of critical maintenance, repairs and upgrades across the NHS estate.

An extra £500m will be injected into delivering road repairs, amounting to a 50% hike to £1.6bn next year.

On rail, the Government committed to upgrade to trans-Pennine rail line between York and Manchester, running via Leeds and Huddersfield, and deliver East West Rail, linking Oxford, Milton Keynes, Bedford and Cambridge.

An extra £200m will be given to Metro Mayors for local transport in 2025/26, bringing City Region Sustainable Transport Settlements to over £1.3bn.

Investment in building safety remediation works will rise to over £1bn in 2025-26. This includes new investment to speed up remediation of social housing.

On the green economy, the Government said it would also fund 11 new green hydrogen projects.

The Government will also take the first step towards a Warm Homes Plan, committing an initial £3.4bn towards heat decarbonisation and household energy efficiency over the next three years.

Around £2.7bn will be spent to support Sizewell C’s development through 2025-26. The equity and debt raise process for this project will shortly move to its final stages and will conclude in the spring.

Budget key tax changes

- Employers NI contribution up from 13.8% to 15% and threshold cut from £9,100 to £5,000 to raise £25bn

- Increasing employment allowance for small businesses from £5,000 to £10,500

- Capital gains tax lower rate up from 10% to 18% and higher rate from 20% to 24%

- Minimum wage to rise by 6.7% in April with rates for over-21s set to go up to £12.21 an hour

- Stamp duty land surcharge for second homes, by 2% to 5%

- Freeze fuel duty next year

- Income tax threshold to be allowed to rise in 28/29

MPU 300_250px.gif)

.gif)