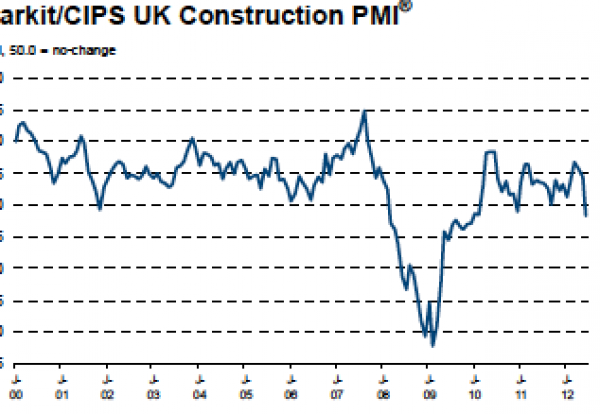

The latest Markit/CIPS Construction Purchasing Managers’ Index fell to 48.2 from 54.4 last time signifying a contraction in the market.

Any figure above 50 on the sentiment survey represents an increase in output.

The dire number brings to an end recent growth predictions among buyers and represents the greatest monthly fall in the index since February 2009.

Some of the drop can be blamed on the extra bank holiday in June. But civil engineering and housing helped drag the index down.

David Noble, Chief Executive Officer at the Chartered Institute of Purchasing & Supply, said: “The renewed declines in construction output and employment are a reflection of the weakening trend in new orders seen in recent months.

“The contraction was accompanied by a similar fall in cost inflation, but this is scant consolation for businesses, as the global economy continues to cast a shadow over the industry.

“Sharp drops in new civil engineering and housing activity were almost matched by the slowdown in commercial activity. The anomaly of the double bank holiday at the start of the month will have had some negative impact but the underlying sluggishness throughout the industry could point towards a much softer period heading into the third quarter.

“Added to this is concern about the ability of firms to respond quickly to any rise in new orders. Delivery times for inputs lengthened again in June due to the low stocks reportedly being held by suppliers, highlighting a further worry for the health of the sector.”

Tim Moore, Senior Economist at Markit and author of the Markit/CIPS Construction PMI, said: “The UK construction sector moved back into reverse gear in June, with output falling at its fastest pace since the end of 2009 amid a steep decline in civil engineering.

“A drop in business activity was perhaps inevitable given that the month started with an additional bank holiday and ended with severe weather across large parts of the UK.

“However, these temporary factors should not be overplayed, as the latest figures reveal worsening underlying business conditions within the sector.

“Construction firms’ assessment of future output dropped to an eight-month low in June, whereas past disruptions, such as heavy snowfall at the start of 2012 and the 2011 Royal Wedding, boosted future expectations as companies anticipated that a catch-up effect would follow.

“New business intakes meanwhile dropped at the fastest pace since April 2009, while a lack of work to replace completed projects resulted in falling employment after a three-month period of cautious job hiring.”

MPU 300_250px.gif)

.gif)